In my experience, business scorecards are widely misunderstood and, as a result, far too few business owners use them.

In this article you will discover not just what a business scorecard is…but why it’s important for every business owner (especially those who are serious about growing their business) to use one and how to create one for your business.

Let’s get started….

What is a business scorecard?

Scoreboards are all around us.

It doesn’t matter what game we’re playing or watching (whether it be golf, cards, football, netball, etc) there’s always a scoreboard.

A scoreboard makes it clear to everyone what the score is.

A scoreboard means we know when someone wins.

A scoreboard shows who wins and who doesn’t.

A scoreboard allows us to change our tactics depending on what the score is.

A scoreboard is vital to any game…especially if you want to win.

SO. In the same way that a game has scoreboard…

….a business should have a scoreboard too.

The business scorecard.

Why is a business scorecard important?

A business scorecard is invaluable because it clearly shows how the business is performing each week.

It answers the question : is the business ahead…on track…or behind where it should be?

Knowing how you’re doing each week means that if one of the numbers is behind target you can take corrective action straightaway to get you back on track.

Just by knowing of a problem sooner AND being able to take corrective action sooner will save the business a LOT of profit and cash.

So, by closely tracking the business scorecard results every week you will also have a good idea as to whether you’re on track to achieving the sales and profit targets for the month.

A well-crafted business scorecard can be used to predict future profitability.

It can act as an early warning system which highlights an area of the business where something isn’t working well and needs focus and attention to put right.

How to create a business scorecard?

Warren Buffett famously said…

“If you can’t read the scoreboard.

You don’t know the score.

If you don’t know the score, you can’t tell the winners from the losers”.

In order to read the numbers on a scoreboard or business scorecard means you have to know what those numbers mean….AND each of those numbers is vitally important to knowing the score.

The secret to creating a business scorecard which you can read is the careful selection of the numbers that go on it.

Rules for creating your business scorecard

When creating a business scorecard there are a six main rules that must be followed.

1. Choose the right numbers

When choosing which numbers need to go onto your scorecard you first MUST be VERY CLEAR on the small number of numbers which are critical to your success.

Each number that goes onto your scorecard MUST be fundamental to achieving your goals for the business.

For instance.

For businesses who want to grow then I would expect many of their key numbers to relate to sales and marketing because ultimately the main goal is to increase sales.

A business scorecard is generally more effective when it has a mix of input and output numbers.

INPUT numbers Typically reflect activity which leads to an outcome (ie an output)

OUTPUT numbers Is the outcome following activity mentioned above.

To illustrate let’s look at possible input and output numbers for SALES & MARKETING.

Input Numbers Amount of marketing spent on Pay Per Click / FaceBook Ads

Number of leaflets sent out

Number of leads / sales enquiries

Number of telephone calls made

Number of meetings with prospective customers

Number of quotes / proposals issued

Output Numbers Number of new customers

Value of new sales orders

Average value of a sales order

Sales Conversation Rate (% of leads who turn into customers)

Lost customer rate (% of customers who leave or are lost)

The input numbers typically revolve around getting prospective customers and the output numbers are typically about converting those prospects into customers and generating revenue.

The principle of input and output numbers doesn’t just relate to sales – it can be applied to any area of a business.

Having put together a list of input and output numbers for your business you need to decide which ones are the MOST important ones which will determine your success.

Not all numbers are the same – some will have a disproportionate effect than others.

What I mean by that is that most businesses will find that a small increase in just one or two numbers will have a big effect on their profit.

It’s a case of having a clarity on the numbers and working out those really important ones….and they certainly must go onto the scorecard.

2. The right number of numbers

I believe the best business scorecards should track around 6 numbers.

Depending on what you feel is important to track, that number may be slightly higher or lower. If it’s higher then I would recommend that you have no more than 10 numbers.

The temptation is to have more than 10.

This is a common but big mistake.

By having more it’s likely to mean that you will end up having a scorecard cluttered by numbers – some of which are NOT vitally important to your success.

A cluttered scorecard filled with so many numbers will lead to overwhelm and everyone will soon become very frustrated by it.

Too many numbers = a lack of focus on what’s really important.

3. It can’t be hard to collect the figures

The figures must be relatively easy for a member of the team to collect or work out.

If it’s hard, and takes a lot of time to collect the figures then that’s not good.

Firstly, it’s likely that more time will be spent working out the numbers meaning less time is spent on improving them.

Secondly, it’s likely that by the time the scorecard is finally produced some of the information will already be out-of-date and therefore not very useful.

4. It must include a target

For every single number on the scorecard there MUST be a target.

Without a target you don’t know how good your actual performance is.

You don’t know if you’re ahead, behind or on track.

The target must come from your annual financial plan (or budget) or latest profit and cashflow forecast.

5. It must show previous results

When you compare the actual numbers against previous ones’ you’re able to see trends. Both good and bad.

Seeing trends is often very helpful.

Downward trends – Can be investigated & take corrective action to improve them?

Upward trends – Can it be amplified so results get even better?

6. It must have accountability

To be truly effective every number must be ‘owned’ by someone in the business.

When this happens you, as the business owner, know that there is someone in the business who is focused on achieving that number & making that number better.

If the number isn’t where it needs to be then that person knows they will have to explain why that is the case and what they’ll be doing to improve it.

The simple fact that someone is responsible and accountable for each number on the scorecard will improve results.

Daily v Weekly v Monthly

For most businesses a weekly scorecard is best.

That means it is produced and reviewed every week and for every week of the year.

If it’s done just once a month then fine BUT it’s not as good as weekly because…

It’s harder to see trends.

It takes longer for possible problems to be spotted, corrective action taken and to get better results.

For a small number of businesses who have huge numbers of transactions then a daily scorecard is what’s needed. The reason being that the volume of transactions is so big that a lot can happen in a week and waiting a week to find out if you’re on track or not and taking corrective action if you’re behind is just too long.

What does a business scorecard look like?

In truth it doesn’t matter what the business scorecard looks like. The important bit is that all the six rules, listed above, are followed.

Probably the easiest way to create, and then complete, a scorecard for most businesses to use is an excel spreadsheet.

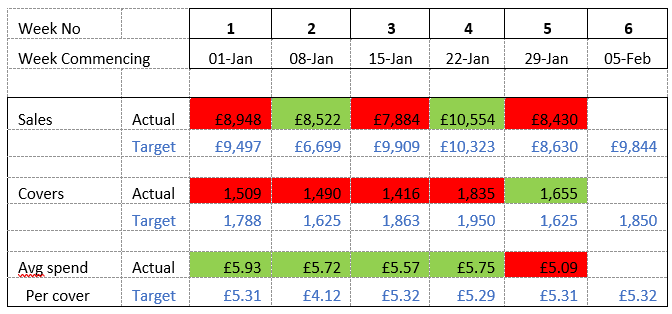

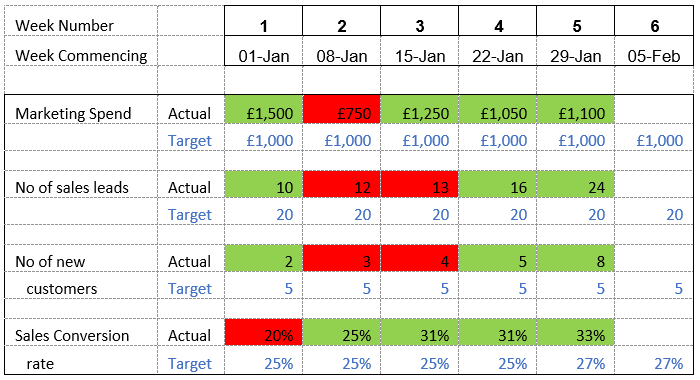

The benefit of using excel is that you can use colour to highlight performance – green for on & ahead of target and red for behind target.

As you will see from the examples below the use of colour makes it much easier to see at a glance what is going well and what isn’t. The numbers highlighted red need your time and focus in order to get them back on track.

To give you a bit of inspiration on how your scorecard should look here are a few examples….

Scorecard for a restaurant

Scorecard for an online seller

In Summary

Any business owner who is serious about growing their business and increasing profits needs to have a weekly scorecard in place….AND be actively using it.

Don’t procrastinate and worry about getting the scorecard right on day one.

It’s imperative that you create and start using the first draft of your scorecard. As the weeks go by you can always change your scorecard so that it includes all the important numbers which everyone needs to be aware of and focus on.

If you don’t know which numbers should be on your scorecard then ask your accountant – a good accountant will be able to give you insights and help as to which numbers would be best.

PS

If you know a fellow business owner who is struggling to put a scorecard in place then please share this article ASAP – it may give them the clarity they need to make progress and grow their business.

Disclaimer

It is important that you take professional advice before making any decisions based on the information that you learnt here. While every effort has been made to make sure it is accurate it cannot be precisely tailored to your personal circumstances. This article is for general information only and no action should be taken, or refrained from, as a result of this information. Professional advice should be taken based on specific circumstances in each individual case. Whilst we endeavour to ensure that the information contained in the article is correct, no liability will be accepted by Krystal Clear Accounting which is a trading name of Kim Marlor Associates Ltd or damages of any kind arising from the contents of this communication, or for any action, inaction or decision taken as a result of using any such information.