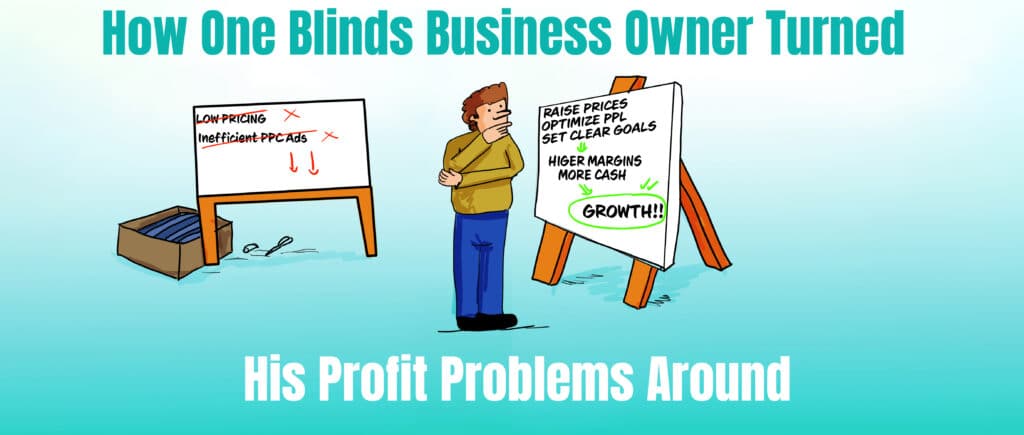

The two hidden problems draining a growing blinds business and how they were fixed.

Running a business can be exhausting, especially when you’re putting in long hours but still struggling to make ends meet. If you’ve ever felt like you’re working harder than ever but your bank balance isn’t reflecting that effort, you’re not alone.

Take James, for example. James ran a blinds business with £225,000 in annual sales, and despite his dedication he found himself barely scraping by.

He was stuck in a cycle of working late, managing staff and dealing with customer requests, yet his profit margins were low.

He tried to solve the problem by pouring more money into Google PPC ads, hoping to bring in more customers. Instead, his bank balance stayed the same—if not worse.

The Hidden Problems That Were Holding Him Back

James’ challenges weren’t because he wasn’t trying hard enough, they were because he didn’t have the right financial strategy. After a deeper dive into his numbers, we uncovered two key issues:

- Pricing Was Too Low – James wasn’t charging enough to cover his costs and generate the profits he needed. While his sales were steady, his profit margins were slim because he didn’t have enough wiggle room to cover things like staff wages, materials and marketing.

- Inefficient Marketing – His PPC campaign was draining his budget and it wasn’t converting at a high enough rate. James was spending £26 per lead with a conversion rate of just 25%, which meant he wasn’t getting enough return on his investment.

These hidden issues were slowly bleeding his business dry, without addressing them, James was stuck in a never-ending cycle of hard work with little reward.

A Simple, Actionable Plan to Turn It Around

James didn’t need to work harder—he needed to work smarter. Together, we put together a simple plan:

1. Raise Prices Gradually – He increased his prices by 10% immediately, then set up a plan to increase them by 5% every quarter. This allowed James to gain confidence in his pricing and improve his margins without losing customers.

2. Optimize PPC Campaigns – We reviewed his Google Ad strategy, cut unnecessary spending and re-targeted his campaigns to attract higher-quality leads. This reduced his costs per lead and improved his conversion rate.

3. Set Clear Targets and Track Progress – We created clear sales and profit targets, then reviewed the results regularly to ensure he stayed on track.

The Results: More Profit, More Cash and Less Stress

James’ numbers started to improve almost immediately. His profit margins grew, he had more cash in the bank and for the first time in a long time – he felt like he was making real progress.

With less pressure on his cash flow, James could finally hire the help he needed to take some of the load off his shoulders. As James was no longer working late every night, he was able to focus on growing the business and making decisions with confidence.

Imagine Your Business with More Profit, More Freedom and Less Stress

James’ transformation is proof, that with the right strategy you can shift your business into a more profitable, sustainable model. A year from now, imagine having more cash in the bank, a clearer path forward and more time for the things that matter. It’s possible—and it all starts with understanding and optimising your numbers.

Ready to take control of your business and see similar results?

Let’s get started today.

The clarity you need to make smarter, more profitable decisions is just a conversation away.

Don’t wait—your business can thrive too.

To get in touch send an email to [email protected] or call us on 0161 410 0020.

Disclaimer

You must take professional advice before making any decisions based on the information that you have learnt here. While every effort has been made, to make sure it is accurate it cannot be precisely tailored to your personal circumstances. This article is for general information only and no action should be taken, or refrained from, as a result of this information. Professional advice should be taken based on specific circumstances in each individual case. Whilst we endeavor to ensure that the information contained in the article is correct, no liability will be accepted by Krystal Clear Accounting which is a trading name of Kim Marlor Associates Ltd or damages of any kind arising from the contents of this communication, or for any action, inaction or decision taken as a result of using any such information.